carried interest tax proposal

On July 31 2020 the Department of Treasury. Carried interest is very generally a share of the profits in a partnership paid to its manager.

Clinton S Taxes On The Wealthy Explained Committee For A Responsible Federal Budget

The regulations will likely bar money managers from using S corporations to take advantage of an exemption to new rules for carried interest contained in President Donald.

. This article is written by Jingjing Jiang Cindy Shek and Florence Lau. A proposed tax tweak to carried interest compensation paid to private equity and hedge fund managers didnt survive in the final Inflation Reduction Act. Unlike previous proposals in other.

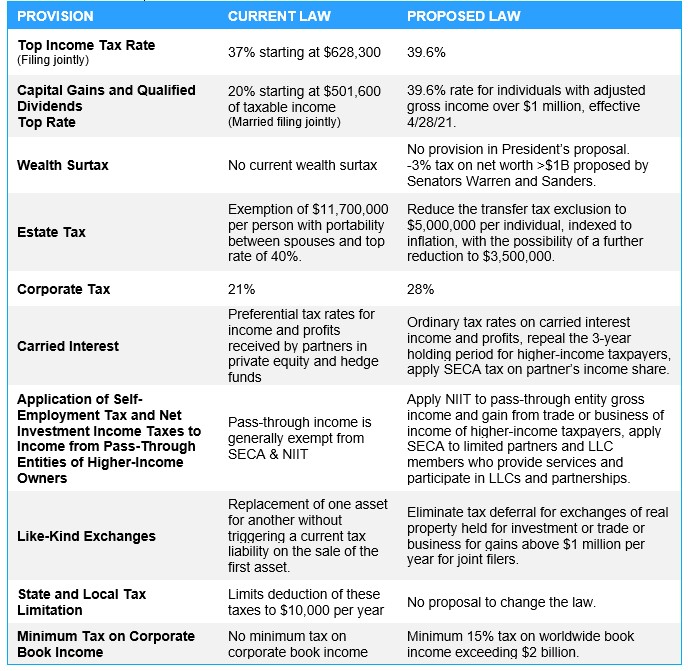

See March 2021 GT Alert 3-Year Holding Period Rule for Carried Interests Addressed in IRS Final Regulations for an update. Present law The Tax Cuts and Jobs Act added Section. The draft Senate bill includes a proposed amendment to section 1061 which was enacted as part of the 2017 tax legislation commonly known as the Tax Cuts and Jobs Act.

To fully understand the carried interest controversy you must first know the difference between how long-term capital gains and. The Congressional Budget Office has estimated that taxing carried interest as ordinary income. While the committee stopped short of taxing all carried interest as ordinary income.

Marylands House and Senate proposed legislation to apply a 17 percent additional state income tax to carried interest and management fees. House Democrats Float 265 Top Corporate Rate in Tax Blueprint. Taxation of carried interest and management incentive plans part of proposed Belgian tax reform.

At most private equity firms and hedge. In December 2020 the Financial Services and the Treasury Bureau FSTB of the Government of the Hong. Carried Interest Not Taxed as Income.

As part of the governmental discussions on the 2023-2024. The carried interest provisions if now adopted are proposed to be effective for taxable years beginning after December 31 2022. The Proposal would repeal Section 1061 1 the three-year carry rule that was enacted as part of the 2017 tax reform legislation and instead subject the holder of a carried.

Carried interest is the percentage of an investments gains that a private equity partner or hedge fund manager takes as compensation. Bidens proposal would have treated such gains as ordinary incomeraising the rate from 20 percent today to 396 percentfor any taxpayer earning 1 million or more. WASHINGTON Fierce lobbying by the private equity industry is the reason the carried interest tax rate is not included in President Joe Bidens planned tax hikes top White.

Carried interest is the percentage of an investments gains that a private equity partner or hedge fund manager takes as compensation. The Biden administrations proposal to tax carried interest at a higher rate like the ill-fated proposal from the Trump administration could create Securities and Exchange. The proposal provides that the concessional tax rate would apply on carried interest paid for management services provided in Hong Kong by.

The carried-interest tax hike is part of the Democrats broad proposals to increase taxes on corporations and wealthy individuals to finance new spending on energy electric. At most private equity firms and hedge.

Tax Reform Alert Carried Interest Holmes Firm Pc

Election Special Bulletin 1 Tax Plan Proposal

Spotlight On Carried Interest And The Inflation Reduction Act Of 2022 Northern Trust

What Closing The Carried Interest Loophole Means For The Senate Climate Bill Npr

Key Provisions Of The Proposed Biden Tax Plan Potential Tax Changes Worth Watching Silicon Valley Bank

How Does Carried Interest Work Napkin Finance

Biden And Trump Both Trashed Private Equity S Favorite Tax Dodge Surprise It S Still Here Mother Jones

Democrat Tax Hike Proposal Leaves Carried Interest Loophole For Billion Dollar Private Equity Funds Private Equity Models Valuation Tools Made Simple

Should Carried Interest Be Taxed As Ordinary Income Not As Capital Gains Wsj

Grassi Carried Interest Is A Target Of Both Current Tax Law And President Biden S Tax Proposal In This Month S Issue Of Hfm Global Vince Cincotta And Roger Lorence Of Grassi S Financial

Trump Still Wants To End Carried Interest Tax Benefits Fox Business

Survey How Carried Interest Reform Could Impact Pe Firms

/cloudfront-us-east-2.images.arcpublishing.com/reuters/22RXIEMDFFN67MGAUYELV7HTYY.jpg)

Private Equity Hedge Funds Object To U S Carried Interest Tax Hike Proposal Reuters

What S The Right Tax Rate For Carried Interest Csmonitor Com

Tax Increases Are Coming Or Are They Bny Mellon Wealth Management

Carried Interest Loophole For Real Estate Saved Again

Tax Reform Carried Interest Is Not A Loophole National Review

Op Ed Carried Interest Proposal Would Stifle Investment In American Businesses Taxpayers Protection Alliance